This morning we woke up to a fantastic piece of news.

We found that two of our smallcases, Q10 and Quiver, have featured among the top-performing smallcases with Q10 at the top and Quiver at the 4th position based on one-month returns.

https://intelsense.smallcase.com

But that is not IMPORTANT!!

Although these small wins give us the confidence that we are progressing in the right direction, our focus remains on the bigger picture which is why we want to talk about the last 3 years.

Both Quiver and Q10 have completed 3 years since launch during which we have been able to stress test both of these strategies using our data-driven and quant-focused approach.

The results have been more than satisfactory.

QUIVER

This is the chart for Quiver.

Quiver has shown exceptional resilience against the Drawdown metric – wherein it has spent less than 10% time in below 20% Drawdown against 21% for the Smallcap index.

Its average rolling return across timeframes has consistently outperformed by more than 500bps.

In fact, it has got better with a higher timeframe with greater than 25% alpha in average return for a 300-day rolling period.

Q10

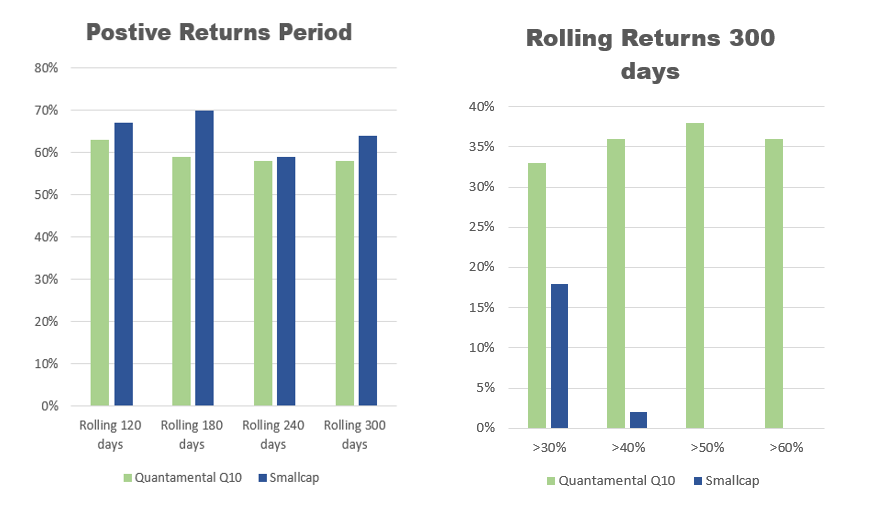

Q10 has also done very well over time.

It is interesting to observe that Q10 performs extremely well in short bursts of time. Over higher time frames, Q10 hits it out of the park with outsized returns of >60% almost 36% of the time and remaining positive on a 120-day holding period time frame 63% of the time.

Note: The data has been taken from smallcase. Please remember that past performance is not indicative of future returns.

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.