Introduction

Edible oils are an indispensable part of daily consumption in India, playing a crucial role in cooking, frying, and seasoning countless dishes. These oils are integral to the Indian culinary landscape and a major component of the average Indian diet.

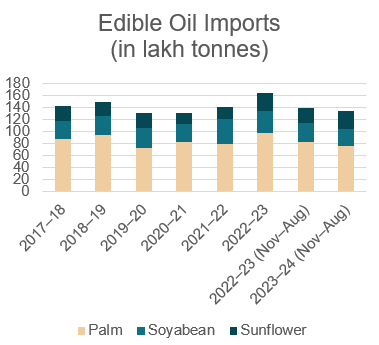

However, despite their importance, India faces a major challenge in meeting its edible oil requirements through domestic production. Currently, around 57% of India’s edible oil needs are met through imports, with the country spending about US$10 billion annually to import nearly 15 million tonnes.

This constitutes close to 70% of India's total annual edible oil requirement of 23 million tonnes. Palm oil alone accounts for more than half of these imports. Such heavy reliance places significant pressure on India’s foreign exchange reserves and exposes the economy to global price shocks.

To address this critical issue, the Government of India launched two ambitious initiatives: the National Mission on Edible Oils – Oilseeds (NMEO-OS) and the National Mission on Edible Oils – Oil Palm (NMEO-OP).

BACKGROUND - India's Edible Oil Challenge:

1. Rising Demand Driven by Population and Income Growth

India's edible oil consumption has witnessed a sharp increase, propelled by a growing population and rising income levels. Annual consumption is currently estimated between 23 to 25 million tonnes, with per capita consumption rising dramatically. As food habits evolve and processed food consumption rises, edible oil demand continues its upward trajectory.

2. High Import Dependence and Vulnerability to Global Price Shocks

Despite being one of the world's largest consumers, India remains heavily dependent on imports for meeting its edible oil needs—importing nearly 57% of its requirement. This dependence exposes India to global supply chain disruptions and price volatility.

Recent examples include:

Indonesia's crude palm oil export ban (2022), which disrupted the import of seedlings critical for India's oil palm expansion.

Fluctuations in global prices of Crude Palm Oil (CPO), impacting farm gate prices for Fresh Fruit Bunches (FFBs) in India.

Shifts in trade dynamics, like the early 2025 fall in palm oil imports due to cheaper soya oil availability, underlining the sensitivity to global market movements.

3. Domestic Production Growth Stagnation vs Growing Imports

While domestic oilseed production has increased—from 275 lakh tonnes in 2014-15 to 365.65 lakh tonnes in 2020-21—it has not kept pace with the surging demand.

Historically, India was self-sufficient in edible oils and even exported them before independence and briefly in the early 1990s. However, the country’s import dependence has steadily risen since then, with $10 billion worth of edible oils (approximately 15 million tonnes) imported annually.

4. Significant Forex Outgo Due to Edible Oil Imports

The scale of imports leads to a massive foreign exchange outflow, straining India's reserves. Palm oil alone accounts for more than half of all edible oil imports and about 60% of all imported vegetable oils. Reducing this import bill by boosting domestic production is critical not just for agricultural self-reliance but also for improving macroeconomic stability.

National Mission on Edible Oils – Oilseeds (NMEO-OS)

The National Mission on Edible Oils – Oilseeds (NMEO-OS) is a strategic initiative by the Government of India aimed at achieving self-reliance in edible oil production by significantly increasing the domestic output of oilseeds.

Under NMEO-OS, the government has allocated a budget outlay of ₹10,103 crore for a period of seven years (2024–25 to 2030–31). The mission sets a target to increase primary oilseed production from 39 million tonnes (2022–23) to 69.7 million tonnes by 2030–31, thereby enhancing India's capacity to meet domestic edible oil demand through internal resources.

By enhancing productivity and acreage under cultivation, NMEO-OS aims to stabilize edible oil prices, reduce import dependency, and improve farmer incomes, especially in rural areas. It reflects a comprehensive effort to revitalize the oilseed sector through a blend of policy support, technology, and collaboration across the agricultural value chain.

National Mission on Edible Oils – Oil Palm (NMEO-OP)

The National Mission on Edible Oils – Oil Palm (NMEO-OP) is a flagship initiative launched by the Government of India in 2021 to promote the cultivation and processing of oil palm as a key step towards reducing India’s heavy dependence on edible oil imports.

The mission comes with a total outlay of ₹11,040 crore and targets an expansion of oil palm cultivation by an additional 6.5 lakh hectares by 2025–26, ultimately covering 10 lakh hectares across India, with a special emphasis on the North Eastern region and Andaman & Nicobar Islands due to their suitable agro-climatic conditions.

By integrating farmers, industry, and state governments into a coordinated ecosystem, NMEO-OP aims to make oil palm cultivation economically viable and environmentally sustainable. The mission not only seeks to increase farmer incomes and create rural employment opportunities, but also contributes significantly to India’s broader goal of becoming self-reliant in edible oils and conserving foreign exchange reserves.

CONCLUSION

In conclusion the National Mission on Edible Oils (NMEO) — stands as a critical national initiative to strengthen India's food security and economic resilience. With the active participation of farmers, who are being supported through subsidies and training, the expertise of scientists in developing high-yield varieties and sustainable practices, and the investment and innovation from the industry in processing and infrastructure, there is a strong sense of optimism that India can successfully reduce its import dependence and move towards self-reliance in the crucial sector of edible oils.

DISCLAIMER

Research Report prepared by Prateek Dugar. SEBI Registered Corporate Research Analyst. Registration: Cupressus Enterprises Pvt Ltd (owner of Intelsense.in) - INH000013828.

Compliance Officer: Soumyadip Roy. Email: equity@intelsense.in

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

This report is issued by Intelsense.in, which is regulated by the SEBI.

References to "Cupressus Enterprises Pvt Ltd" or “Intelsense.in” in this report shall mean Cupressus Enterprises Pvt Ltd unless otherwise stated. This report is prepared and distributed for information purposes only, and neither the information contained herein, nor any opinion expressed should be construed or deemed to be construed as solicitation or as offering advice for the purposes of the purchase or sale of any security, investment, or derivatives. The information and opinions contained in the report were considered by Intelsense.in to be valid when published. The report also contains information provided by third parties. The source of such information will usually be disclosed in the report. Whilst Intelsense.in has taken all reasonable steps to ensure that this information is correct, it does not offer any warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading does so entirely at his or her own risk and Intelsense.in does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements and past performance is not necessarily an indication of future performance.

This report does not regard the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors must undertake independent analysis with their own legal, tax, and financial advisors and reach their own conclusions regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realised. Under no circumstances can it be used or considered as an offer to sell or as a solicitation of any offer to buy or sell the securities mentioned within it. The information contained in the research reports may have been taken from trade and statistical services and other sources, which Intelsense.in believe is reliable. Intelsense.in, Cupressus Enterprises Pvt Ltd or any of its group/associate/affiliate companies do not guarantee that such information is accurate or complete and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice.