1.

Persistence vs Obstinacy

Successful people tend to be persistent. New ideas often don't work at first, but they're not deterred. They keep trying and eventually find something that does.

Mere obstinacy, on the other hand, is a recipe for failure. Obstinate people are so annoying. They won't listen. They beat their heads against a wall and get nowhere.

But is there any real difference between these two cases? Are persistent and obstinate people actually behaving differently? Or are they doing the same thing, and we just label them later as persistent or obstinate depending on whether they turned out to be right or not?

Five distinct qualities — energy, imagination, resilience, good judgement, and focus on a goal — combine to produce a phenomenon that seems a bit like obstinacy in the sense that it causes you not to give up. But the way you don't give up is completely different. Instead of merely resisting change, you're driven toward a goal by energy and resilience, through paths discovered by imagination and optimized by judgement. You'll give way on any point low down in the decision tree, if its expected value drops sufficiently, but energy and resilience keep pushing you toward whatever you chose higher up.

2.

Valuations won’t tell you much about next year

While valuation methods may tell you something about long-term returns, most tell you almost nothing about where prices are headed in the next 12 months. Over short periods like this, expensive things can get more expensive and cheap things can get cheaper.

It’s worth noting that prices can be cheap or expensive for extended periods of time. In fact, some folks would argue valuations are not mean-reverting.

Read this and 9 more such interesting points in the article linked below.

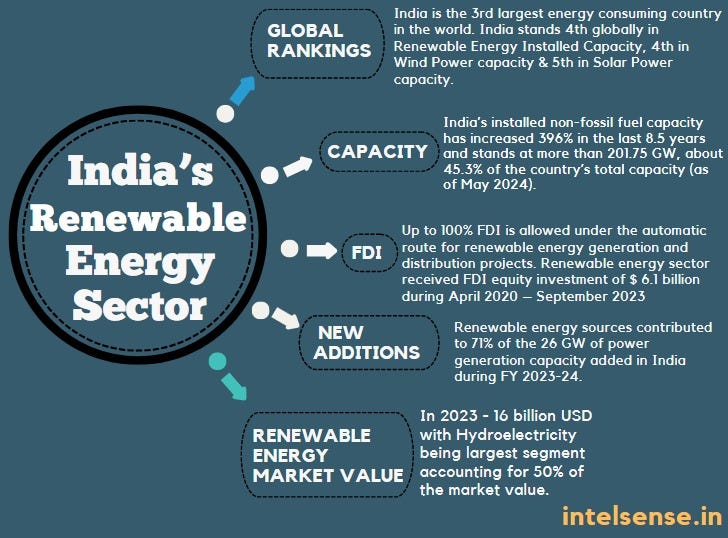

Pic of the Week

Thought of the Week

“The irony is that this is a money game and money is the way we keep score. But the real object of the Game is not money, but it is the playing of the Game itself. For the true players, you could take all the trophies away and substitute plastic beads or whale’s teeth; as long as there is a way to keep score, they will play.” ~ Adam Smith

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.

good video. I too use similar parameters mentioned in your video using screener.in data. Right now everything seems to be way too expensive on p/e, Marketcap to Sales parameters, growth in topline/bottomline, etc! So, am not buying any. Will wait for that fat pitch instead!