1.

Never be too certain

Sometimes things go as people expected, and they conclude that they knew what was going to happen. And sometimes events diverge from people’s expectations, and they say they would have been right if only some unexpected event hadn’t transpired. But, in either case, the chance for the unexpected – and thus for forecasting error – was present. In the latter instance, the unexpected materialized, and in the former, it didn’t. But that doesn’t say anything about the likelihood of the unexpected taking place.

Why is it that stock prices rise and fall so much more than the economies and companies that underlie them? And why is it that market behavior is so hard to predict and often seems unconnected to economic events and company fundamentals? The financial “sciences” – economics and finance – assume that each market participant is a homo economicus: someone who makes rational decisions designed to maximize their financial self-interest. But the crucial role played by psychology and emotion often causes this assumption to be mistaken. Investor sentiment swings a great deal, swamping the short-run influence of fundamentals. It’s for this reason that relatively few market forecasts prove correct, and fewer still are “right for the right reason.”

2.

Asking better questions

There’s an under-appreciated beauty in formulating a “good” question. What we ask, and how we ask it, determines what we'll discover. People often think about asking questions in ways that make sure the other person will have no choice but to answer it. But it’s nice to think about the practice of formulating questions as an art form in itself. Coming up with questions is also an act of creation. Understanding and honing the way you inquire about the world can be as active as getting answers to those inquiries.

There’s plenty of advice out there on asking good questions. Be a good listener. A good question begins by accepting that there are degrees to understanding. We’ll never know the full extent of anything; it’s humbling and it’s exciting. A question emerges in response to a gap, and a gap is usually noticed when you have existing knowledge to organise in a way that reveals it. You also need to be willing to return to basics once in a while — to open up a blank document, type down everything you think you know about a subject, and identify the gaps that take shape.

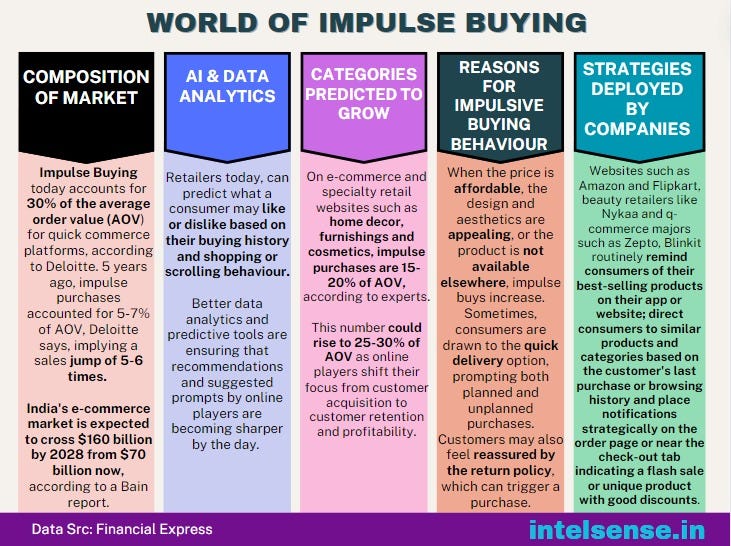

Pic of the Week

Thought of the Week

"Success is when your kids want to be with you when they're adults." ~ Paul Orfalea

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.