1.

Live to fight another day

No matter how confident we are in our business assessments or valuation work, strange things can happen, and we must be prepared for that. Rory Sutherland recently told Rick Rubin that “Everybody when they look for a reason for something serious is looking for a serious reason…but actually great things happen for stupid reasons.” Great things happening in this context can be positive or adverse events.

Be in a position for luck to help your returns but not break your returns.

Position sizing is a dance between playing to win and playing not to lose. Ultimately, you must have capital to compound capital.

2.

Change in stock prices is dependent on the perception of the future

Mood swings do a lot to alter investors’ perception of events, causing prices to fluctuate madly. When prices collapse as they did at the start of this month, it’s not because conditions have suddenly become bad. Rather, they become perceived as bad. Several factors contribute to this process:

heightened awareness of things on one side of the emotional ledger,

a tendency to overlook things on the other side, and

similarly, a tendency to interpret things in a way that fits the prevailing narrative.

What this means is that in good times, investors obsess about the positives, ignore the negatives, and interpret things favorably. Then, when the pendulum swings, they do the opposite, with dramatic effects.

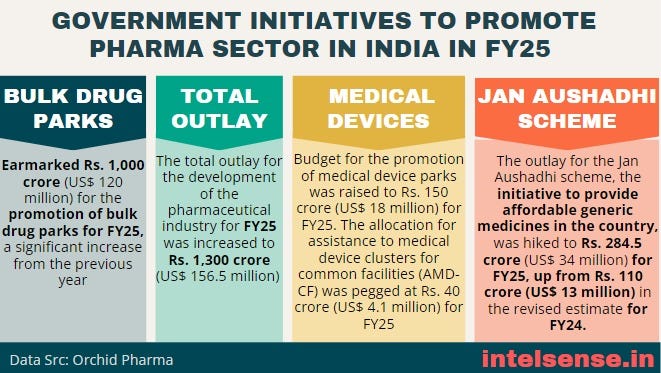

Pic of the Week

Thought of the Week

The strategy required to find a great opportunity (lots of saying yes and exploring widely) is different from the strategy required to make the most of a great opportunity (lots of saying no and remaining focused).

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.