NOTIFICATION:

With the new SEBI RA guidelines, we are assessing additional actions to be taken. Till then new subscriptions to our advisory services will remain suspended.

If you are interested in being a subscriber, please mail equity@intelsense.in, and we will notify you when subscriptions are open again.

To invest in our PMS for an investment corpus of 50 lakhs and more, drop us a line at equity@shreerama.co.in

1.

Frameworks of thought

Good judgment is a function of mental models or frameworks. If you come across anyone who you deem to have great judgment, understanding their framework of thought is a critical part of understanding their decision-making.

Once you develop frameworks, and it is best done as soon as you can in your career, 80% of all decisions are actually generic.

Once you've created these mental models, that saves a tremendous amount of time and energy and allows your focus to be used only on critical areas and help reduce error rate.

From a focus perspective, the key question is: How do you maximize your return on time? Time is by far the most scarce commodity for us as investors.

Judgment and insight is not a function of time. It's actually a function of repetitions within a framework of thought. Functions of exposure to decision points in a data set to condition that pattern recognition and then help refine your judgment. Pattern recognition is exposure to statistically significant data sets which enable you to form causal relationships. And then judgment is exposure to enough decisions and feedback loops to refine within a mental model or framework of thought.

Knowledge for its own sake is important, but not particularly useful in investing. The whole point of this is to find knowledge that you can apply to current market conditions.

2.

Focus on behavioral biases for better investments

There are two elements that are central to short-term investor decision making – emotional stimulus and friction.

Emotional stimulus simply means that how we feel impacts and often overwhelms the choices we make. This could be fear, greed, anxiety, excitement, envy or a multitude of other things.

The problem for investors is that we are engulfed by a constant barrage of financial market babble that inevitably provokes an emotional response. We can see how our portfolio performs minute by minute, we hear about the incredible successes of other investors on social media, we get bombarded with news about every market fluctuation. All of these things make us feel something, which often compels us to take action.

This might be harmless enough if it were it not coupled with another development – the removal of friction from our investment decision making.

The issue for investors is that technological developments have made many things easy – checking portfolios and trading – but without careful consideration of the negative behavioural implications. Investors have ended up in a situation where we are overwhelmed by emotional stimulus and have no friction to stop ourselves reacting to it.

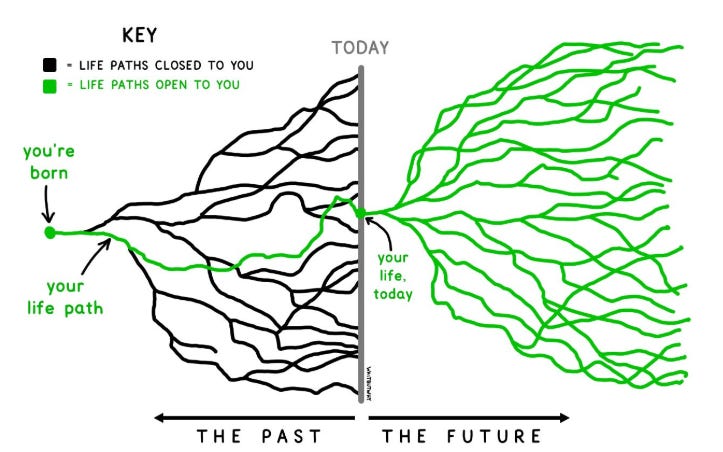

Pic of the Week

Thought of the Week

“The secret to doing good research is always to be a little underemployed. You waste years by not being able to waste hours.” – Amos Tversky

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.