1.

Don’t let lifestyle creep spoil your financial freedom

A working paper released by the US National Bureau of Economic Research (NBER) looked at earnings across peoples’ lifecycles and found that “positive shocks to high-income individuals are quite transitory, whereas negative shocks are very persistent; the opposite is true for low-income individuals.”

In other words, if you’re already making a high income, making more is usually temporary, while making less is usually permanent. If a company hits a rough patch or the economy goes into recession, highly paid employees can be seen as a potential target for cost-cutting measures.

This is the fundamental problem with a high burn rate that is linked to a single income source. It’s simply too risky. This explains why many retired athletes eventually go broke even though their spending wasn’t a high percentage of their income while they played.

The issue here wasn’t their income, it was their spending. The problem is that once you get used to a certain lifestyle, it can be painful to take a step back.

2.

The new protein - comes from microbes

A new crop of biotech startups, armed with carbon-guzzling bacteria and plenty of capital are hoping to convince us that they can make food out of thin air.

In nature, these “autotrophic” microbes survive on a meagre diet of oxygen, nitrogen, carbon dioxide, and water vapour drawn directly from the atmosphere. In the lab, they do the same, eating up waste carbon and reproducing so enthusiastically that their populations swell to fill massive fermentation tanks. Siphoned off and dehydrated, that bacterial biomass becomes a protein-rich powder that’s chock-full of nutrients and essentially infinitely renewable.

Microbial protein “farms” could operate year-round anywhere renewable electricity is cheap—even in places like Chile’s Atacama Desert, where farming is nearly impossible. That would take the strain off agricultural land—and potentially even give us the chance to return it to the wild.

Pic of the Week

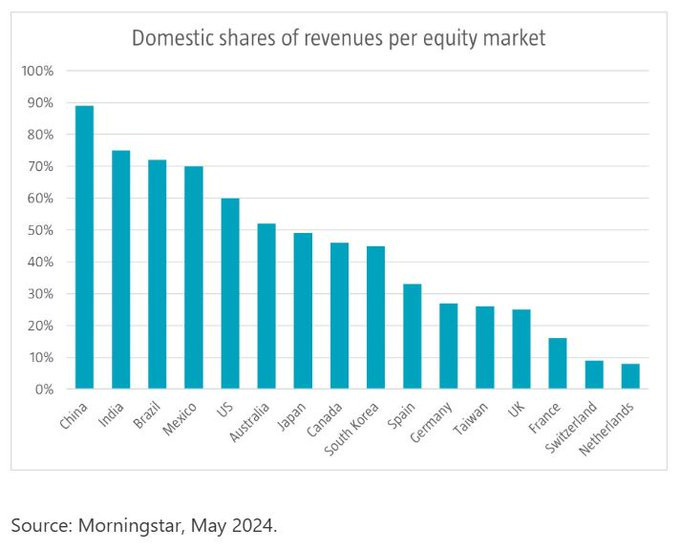

Interesting that the domestic revenues of Chinese-listed companies is nearly 90%. India is also a very domestic-centric market with almost 75% of revenues from within.

Thought of the Week

“When one door closes, another opens; but we often look so long and so regretfully upon the closed door that we do not see the ones which open for us.” ~ Alexander Graham Bell

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.