1.

Stocks are businesses

Most of the time, social systems are too messy to abstract from patterns and odds into universal laws and axioms. However, one axiom does form the foundation of all my investing – stocks are businesses. Naturally, anyone with a passing familiarity of markets knows that this axiom isn’t universally valid. At any point of time, stock price level and direction seem unrelated to underlying business. However, this axiom holds well enough, on average, over time, for me to think of stocks as businesses. I spend all my time figuring out whether I can understand the underlying business well enough to gauge what’s a safe enough buy-price relative to what the business is roughly worth. If this axiom were to break, my entire investing approach would collapse. That stocks are businesses is my first axiom of investing. It is true by definition and valid in reality, at least in a general sense.

2.

Reversible and irreversible decisions

Decisions fall somewhere on the continuum from reversible to irreversible. You can tell where a decision lies on this spectrum by asking how much it would cost to undo. The higher the cost to undo, the more irreversible it is. The lower the cost, the more reversible it is.

Perhaps an example will help illustrate the point. After brushing your teeth this morning, you run to the store to grab some toothpaste. However, they are out of your usual brand. Since the decision is easily reversible, you quickly grab a package that looks decent and take it home. If the toothpaste is terrible, you can easily get another type tomorrow. Now consider an irreversible decision. Imagine you are the manager of an NBA team. You’re thinking about trading one of your star players away. Once made, that decision can’t (easily) be undone.

Once you learn to see decisions through the lens of reversible and irreversible, everything changes. It also changes how you make decisions.

Make reversible decisions as soon as possible and make irreversible decisions as late as possible.

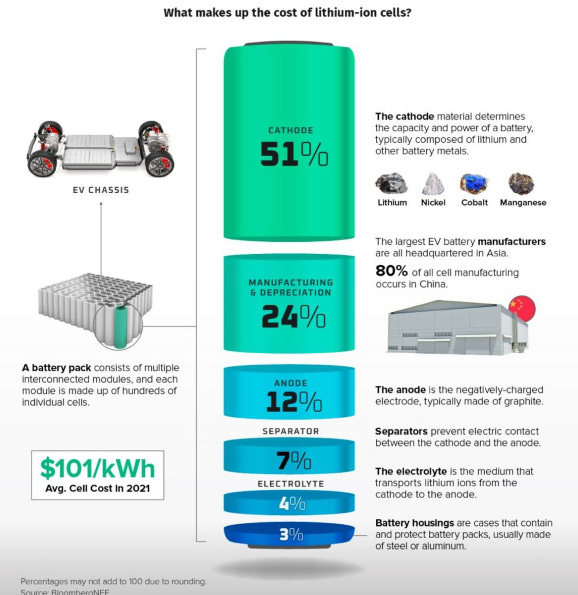

Pic of the Week

Thought of the Week

“The way they deal with money is a result of how they think about money, not of how much money they have.”

“Money on its most basic level is a hard fact — either you have it or you don’t. But on its emotional and psychological level it is purely a fiction. It becomes what you let it become.”

~ Kent Nerburn

Video of the Week

Intelsense Insights

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.