For equity advisory services or to invest in PMS, visit intelsense.in

1.

Use systems to perform better than even experts

Rules match or beat expert-level decision-making 94% of the time, which is pretty staggering. And we see this across contexts. We see this everywhere from medical diagnosis to stock picking to financial planning to prison recidivism studies. That one’s one of my favorites — they went from sort of having these soul-searching interviews with prisoners to looking at two variables, you know, what are they in for? And how did they act while they were in — and they increased the efficacy of their judgments by almost 400%.

When you apply overconfidence bias to investing, there’s three specific ways that we’re overconfident. The first is we think we’re better than average. Smarter, better, faster, stronger, better at picking stocks.

Secondly, we think we’re luckier than average. So, you ask people, what’s the likelihood of something happening to you, like getting divorced and effectively no one says they’ll get divorced, even though, you know, one in two people gets divorced. No one thinks they’re going to get cancer or, you know, have diabetes and so on. But if you ask people about their odds of finding love or winning the lottery they dramatically overrate these probabilities. We sort of tend to own the optimistic and delegate the dangerous.

Ahen the third one is we think that we’re more prescient about the future than we actually are. Like we think we’re better at forecasting what’s going to happen. So, these three forms of overconfidence are a pretty toxic cocktail of bad decision making.

2.

Know yourself and create your own path

You also, I think, need an element of contrarianism if you're going to be a good investor. And that means you have to be prepared at times to do things that feel slightly uncomfortable. The dangerous thing I think, is to do what everyone else is doing. And often, if it feels too comfortable, and you are doing something that is very popular, you must realize that that carries some extra risks with it. The popularity in itself carries a risk.

But behind this, I think, really, you have to know yourself. You have to know your strengths and weaknesses. I think to be a good investor, you need to be somewhat unemotional and detached from the stock market. And you need to be honest with yourself. Just knowing what your strengths and weaknesses are really important. In my career, I think it's really helped. I've had a contrarian approach, but I've known that that's something that works for me, and I think you need to be able to work out what sort of approach works for you as an investor and stick to it.

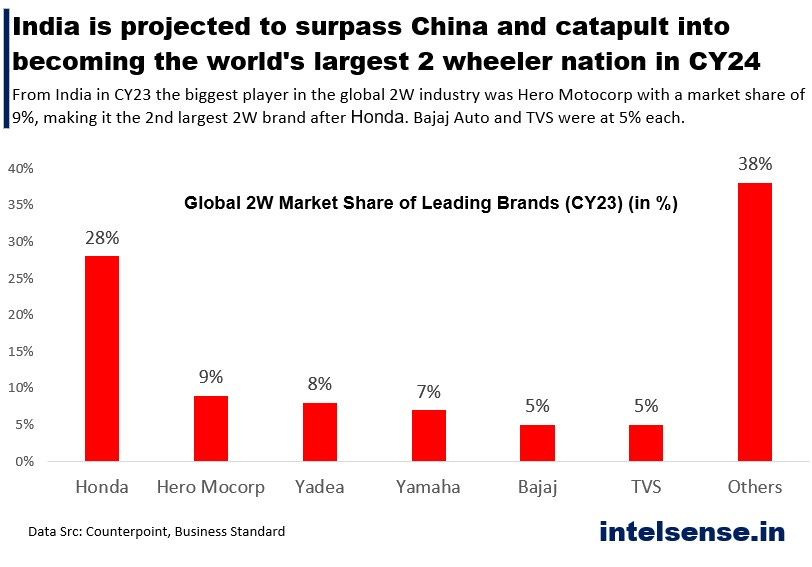

Pic of the Week

Thought of the Week

“The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function. One should, for example, be able to see that things are hopeless yet be determined to make them otherwise.” ~ F. Scott Fitzgerald

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.