To invest in our PMS for an investment corpus of 50 lakhs and more, drop us a line at equity@shreerama.co.in

In The Media

1.

Managing investment risk

“Risk means more things can happen than will happen.”

This definition gets to the core of how investors should consider risk. Risk is an absence of certainty. Risky situations are defined by there being a range of potential future outcomes and some unknowable probability attached to those outcomes.

There are only three things that really matter:

Understanding the potential range of outcomes and their probabilities.

Reducing the probability of very bad outcomes (cutting the tail).

Increasing the probability of good outcomes.

Risk management often goes wrong and it does so both behaviourally and technically. Behaviourally, because we have a plethora of biases – extrapolation, overconfidence, availability, recency etc – which mean we worry about the wrong things and are complacent about issues that should matter. Technically, because we try to precisely measure things where it is impossible to do so – inevitably becoming overly reliant on inherently limited metrics. If we use a single number to measure risk, we are not thinking about risk in the right way.

We don’t know much about the future, but we know more things can happen than will happen. We should invest with this in mind.

2.

The Five Big Changes by Ray Dalio

The current monetary and economic order is collapsing due to unsustainable debt levels, with debtor nations like the U.S. addicted to borrowing and creditor nations like China reliant on lending and exports. These imbalances—driven by trade dependencies, geopolitical tensions, and declining trust—are untenable in a deglobalizing world where self-sufficiency is prioritized. The existing system, where China finances U.S. consumption while America’s manufacturing weakens, must undergo major disruptive changes to correct these excesses, reshaping global capital markets and economies.

The domestic (US) political order is collapsing due to widening disparities in education, opportunity, wealth, and values, along with the government’s inability to address these issues. This fuels extreme polarization, with left and right populists engaging in zero-sum power struggles, undermining democracy’s need for compromise and rule of law. Historically, such breakdowns lead to the rise of autocratic leaders as democratic norms weaken. The instability will likely worsen due to economic and market crises, further disrupting politics and geopolitics.

The international geopolitical order is collapsing as U.S. dominance wanes, shifting from a cooperative, multilateral system to a unilateral, power-driven era where major nations—like the U.S. (now adopting an "America First" stance), China, and others—compete aggressively through trade wars, tech conflicts, and military tensions, with no single power able to impose global rules.

Acts of nature (droughts, floods and pandemics) are increasingly disruptive.

Amazing changes in technology such as AI will be highly impactful to all aspects of life, including the money/debt/economic order, the political order, the international order (by affecting interactions between countries economically and militarily), and the costs of acts of nature.

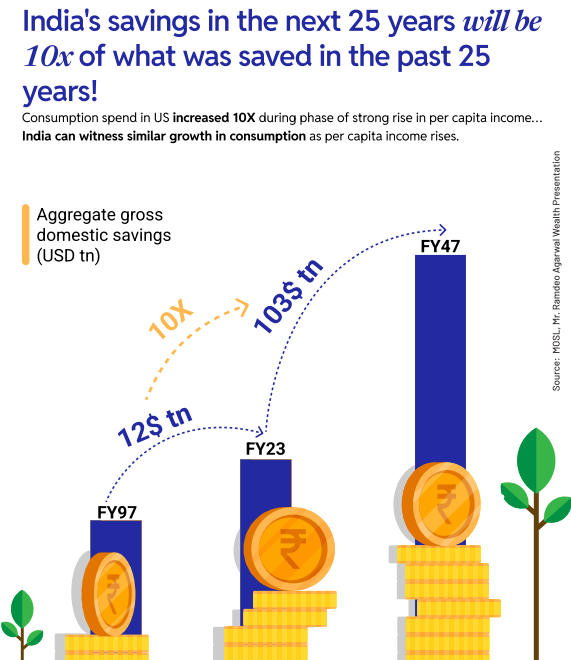

Pic of the Week

Thought of the Week

You make most of your money in a bear market, you just don’t realise it at the time.— Shelby Davis

“Survival is the ultimate performance measure.” – Vicki TenHaken

Video of the Week

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.