India’s Finance Minister gave the full-year budget for 2025-25. This was the second one this year as the previous one was a vote-on-account because of the central elections.

Budgets are usually non-events

I have maintained that budgets are not a very important event but the breathless 24x7 news media make it a spectacle because they have to have something to do at all times. Talk about incentive-caused bias.

I have actively followed 26-27 budgets. Of which I remember at most 3. I am pretty sure I will also probably forget about this budget in about six months. I might remember that capital gains taxes were increased but that is also questionable. I don’t even remember when, for example, LTCG was hiked from 0 to 10%. And the reason I don’t remember is it really does not matter. Unless taxes become usurious it is the cost of doing business. I will not stop investing because taxes are 12.5% today versus 10% yesterday.

Key features of this budget

The only major use of the budget for investors is that it shows the government's intent through its allocations.

This year defence, railways and renewable energy get the most focus, in addition to employment and skilling.

Fig 1: High-level budgetary allocation

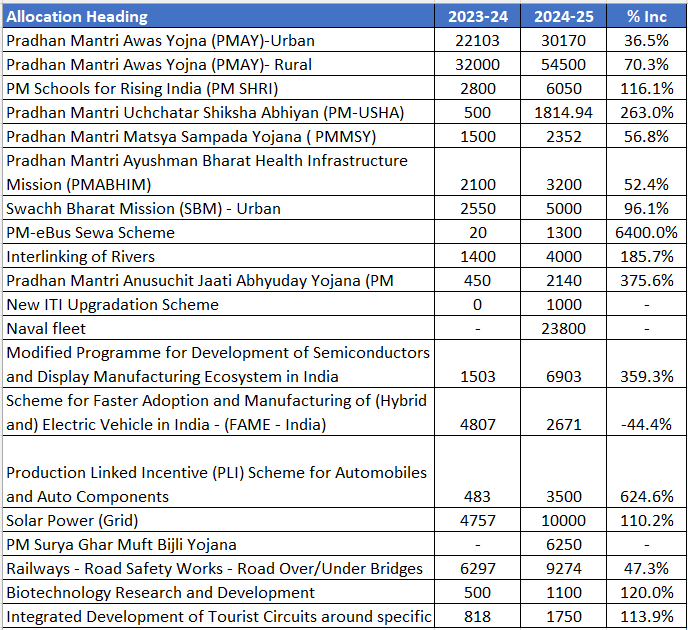

When we turn to the central policies and outlays for them with a slightly granular approach, we find that the focus is on the following:

Mass housing

Education (schools, ITI)

Swachh Bharat

e-Bus

Semiconductors

Solar power

Navy ships

Tourism

Fig 2: Details of outlays for central policies and programs

Summary

Now we know the focus areas for the government to spend on. Ignore the market noise and volatility around the raising of capital gains tax and focus on getting the capital gains in the first place :-)

DISCLAIMER:

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

SEBI Registered Research Analyst - Cupressus Enterprises Pvt Ltd - INH000013828.

Registration granted by SEBI and certification from NISM does not guarantee the intermediary's performance or provide any assurance of returns to investors.

Tax is the cost of doing business. Both LT and ST taxes have gone up, ST sightly more than LT. Directionally, we have to be prepared for higher taxes overall in the coming years.

My point is simply that instead of thinking about taxes, we should be focused on getting the returns first. Even as you say, in breakout trading, if you are a profitable trader, you will still make a lot of money.

Sir, I respectfully disagree with your assessment on stcg, ltcg. I think the 33% increase in stcg is substantial (from 15% to 20%). Your short term services like quiver, quantamental, hitpicks, pms vriddhi have done extraordinarily well the last 2 years. I think all of them will straightaway lose post-tax performance of 5% on absolute basis (and 2.5% relative to long-term plans). This is significant. I would be more selective in breakout trading for example.